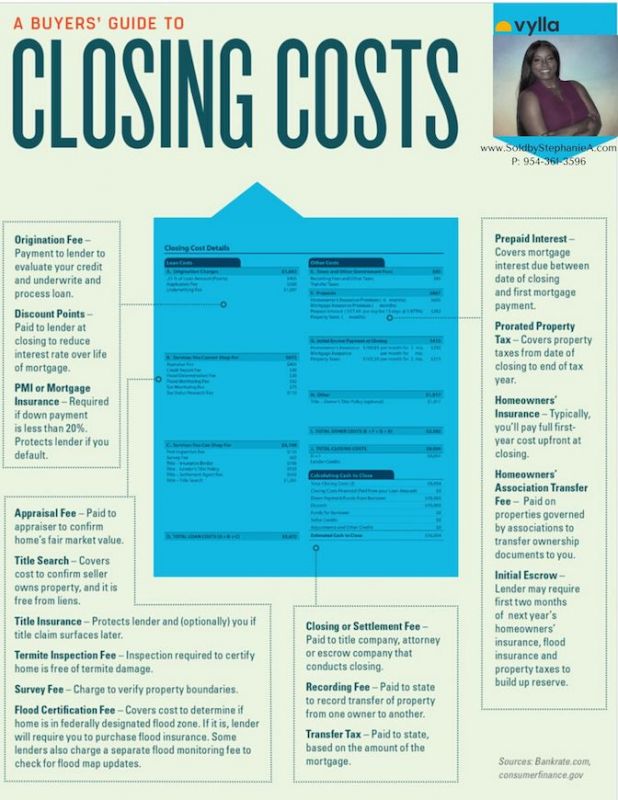

Appraisal Fee: Paid to appraiser to confirm home’s fair market value

Closing or Settlement Fee: Paid to title company, attorney or escrow company that conduct closing

Discount Points: Paid to lender at closing to reduce interest rate over the life of the mortgage

Flood Certification Fee: Covers the cost to determine if homes in federal designated flood zone. If it is, lender will require you to purchase flood insurance. Some lenders also charge a separate flood monitoring fee to check for flood map updates.

Homeowners' Association Transfer Fee: Paid on properties governed by association to transfer ownership documents to you

Homeowners' Insurance: Typically, you’ll pay full first year cost up front at closing

Initial Escrow: Lender may require first two months of next year’s homeowners’ insurance, flood insurance and property taxes to build up reserves

Origination fee: Payments to lender to evaluate your credit and underwrite and process loan

PMI or Mortgage Insurance: Required if down payment is less than 20%. Protects lender if you default

Prepaid Interest: Covers mortgage interest due between date of closing and first mortgage payment

Prorated Property Tax: Covers property taxes from date of closing to end of tax year

Recording Fee: Paid to state to record transfer of property from one owner to another

Survey Fee: Charge to verify property boundaries

Terminate Inspection Fee: Inspection required to certify home is free of termite damage

Title Insurance: Protects lender and (optionally) you if title claim surface later

Title Search: Covers cost to confirm seller owns property, and it is free from liens

Transfer Tax: Paid to the state, based on the amount of the mortgage